Q3FY2019 Result Update | Banking

Feb 14, 2019

Axis Bank

BUY

CMP

`697

Performance Highlights

Target Price

`860

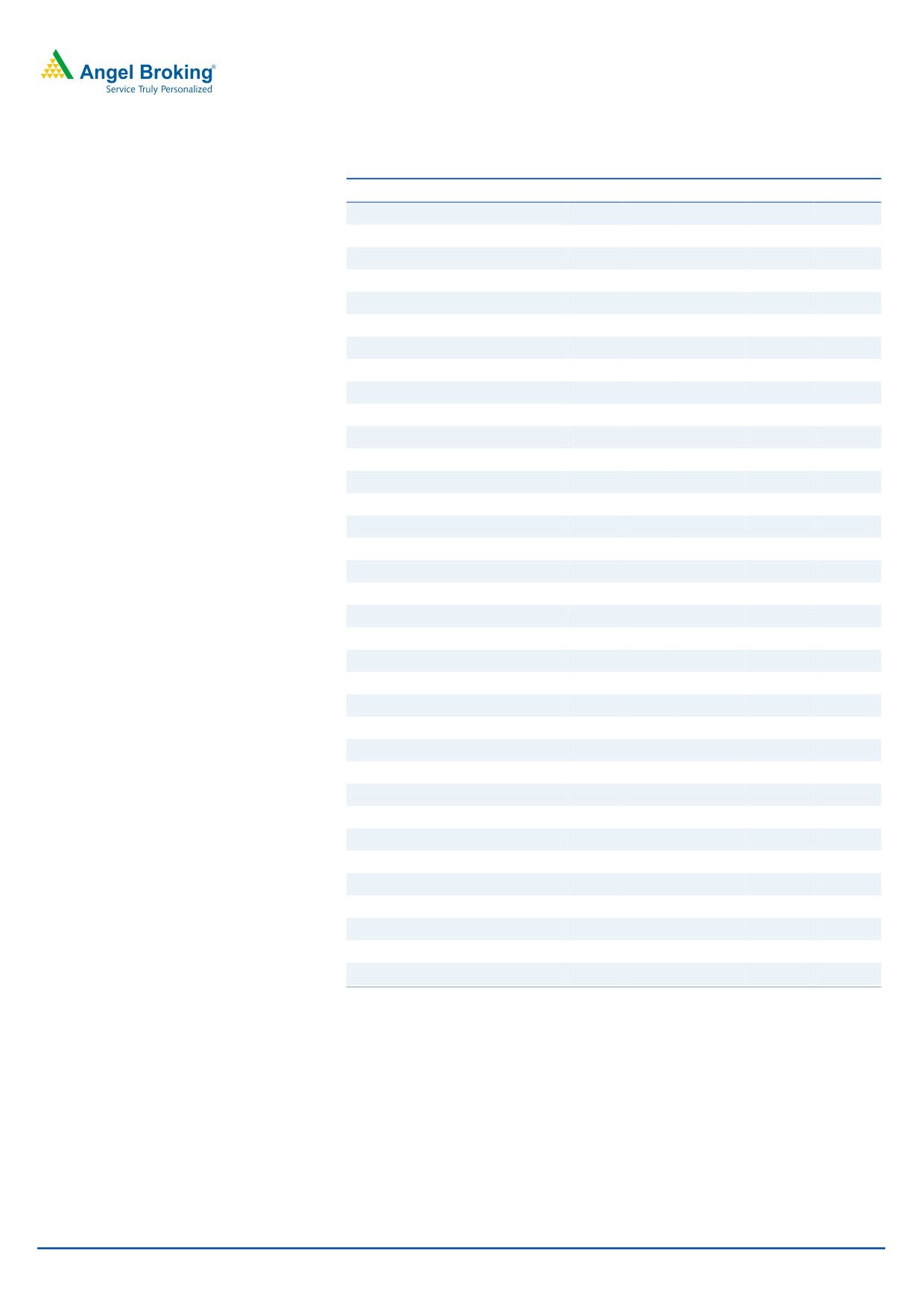

Particulars (` cr)

Q3FY19

Q2FY19

% chg (qoq)

Q3FY18

% chg (yoy)

Investment Period

12 Months

NII

5,604

5,232

7.1

4,732

18.4

Stock Info

Pre-prov. profit

5,525

4,094

34.9

2,811

96.5

PAT

1,681

790

112.8

726

131.3

Sector

Banking

Source: Company, Angel Research

Market Cap (` cr)

1,79,205

Beta

1.1

For Q3FY2019, Axis Bank reported PAT of `1,681cr, which is the highest in past

52 Week High / Low

734/477

11 quarters. This was supported by steady NII growth (18.4% yoy), and recovery

Avg. Daily Volume

1,84,725

of `998cr from written off accounts.

Face Value (`)

2

Retails loan drive loan growth momentum; NIM improved marginally: During

BSE Sensex

36,034

Q3FY2019, the bank’s advances grew by 13% yoy, with retail and SME growing

Nifty

10,793

at 20% yoy and 13.4% yoy respectively. The NII during this period grew by 18.4%

Reuters Code

AXBK:NS

yoy, led by advances growth and improvement in NIM. Uptrend in NIM over last

Bloomberg Code

AXSB:NATL

3 quarters was led by corporate book coupled with re-pricing of marginal cost of

funds based lending rate (MCLR) linked loans (60bps increase in MCLR in 3Q).

The return of pricing power owing to lesser competition from NBFCs and

Shareholding Pattern (%)

improving asset quality will support NIM.

Promoters

23.7

MF / Banks / Indian Fls

15.8

Elevated slippages; fresh accretion of NPA to be moderate going ahead:

Annualised slippages for Q3FY2019 was tad higher at 3.2%. However, we expect

FII / NRIs / OCBs

47.2

fresh accretion of NPA to be lower owing to (1) sub investment book has declined

Indian Public / Others

13.2

by 72% from Q1FY2017 and now stands 1.6% of advances; (2) management

stated elevated downward cycle is nearing an end; (3) PCR including technical

write-offs at 75%, bank has taken additional contingent provisions of `600cr for

Abs. (%)

3m 1yr

3yr

potential downgrade from sub investment book.

Sensex

4.5

6.1

58.6

Management guides for 18% ROE in the medium term: The bank's MD & CEO

has given ROE target of 18% in medium term, which will be driven by strong

Axis Bank

14.2

28.7

78.4

growth momentum in the retail segment and pick up in its corporate book

through improved product mix, better operating efficiency, and reduction in credit

costs to below its long-term average via improvement in asset quality.

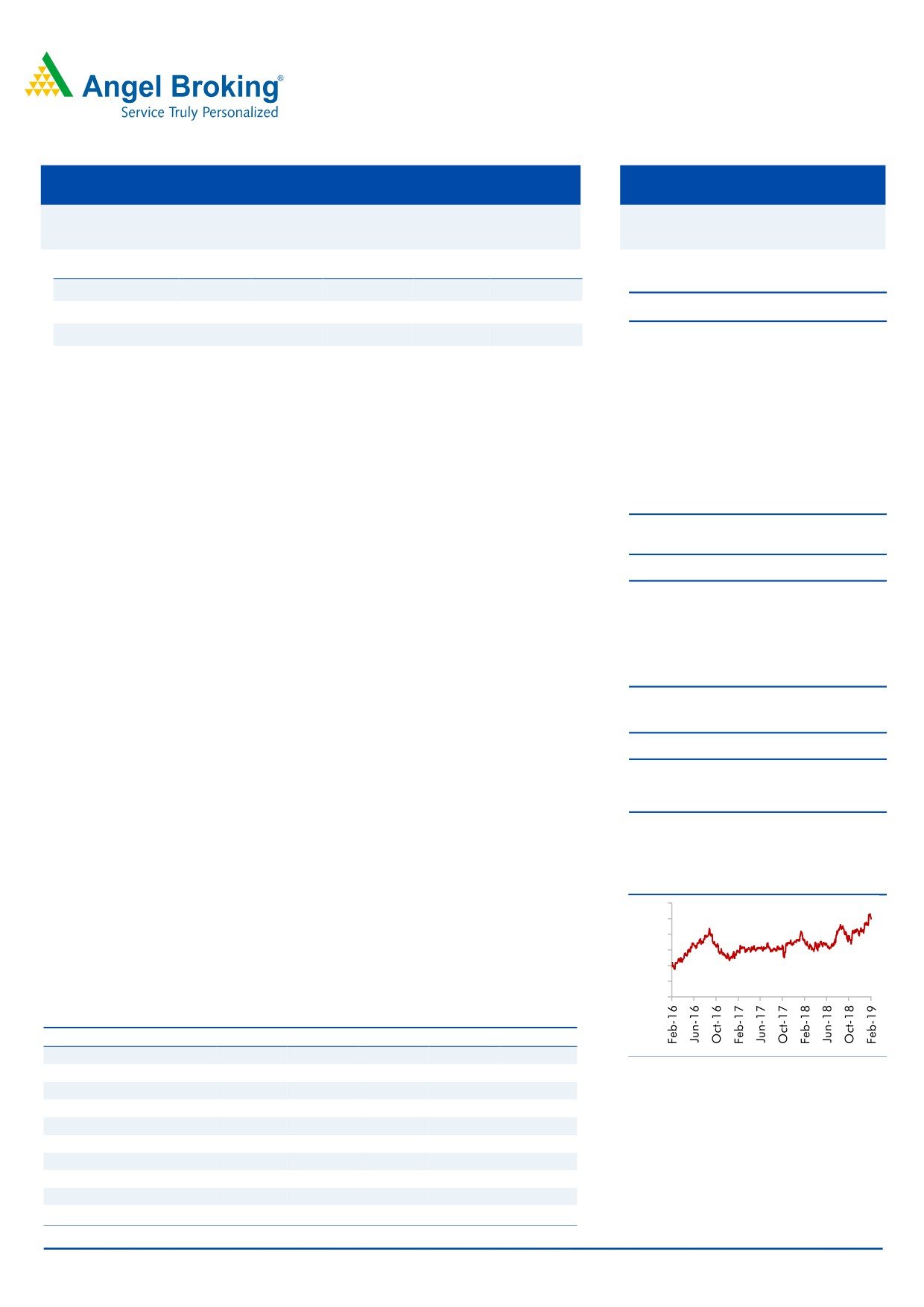

3-year price chart

Outlook & Valuation: Axis Bank currently trades at 2.1x its FY2021E price to book

800

value (after adjusting value of subsidiaries). We expect the stock to get re-rated

700

600

owing to (1) new leadership; (2) limited stressed loan pool; (3) improvement in

500

return ratios (ROA/ROE - 1.1%/12.2% by FY2020E). We recommend Buy on the

400

300

stock with a Target Price of `860.

200

Exhibit 1: Key Financials

Y/E March (` cr)

FY17

FY18

FY19E

FY20E

FY21E

NII

18,093

18,618

21,882

25,878

32,134

Source: Company, Angel Research

% chg

7

3

18

18

24

Net profit

3,679

276

4,694

8,678

10,784

% chg

-55

(93)

1,603

85

24

NIM (%)

3.4

3.1

3.2

3.3

3.6

Jaikishan Parmar

EPS (`)

14

1

18

34

42

P/E (x)

49

649

38

21

17

Research Analyst

P/ABV (x)

3.3

3.1

2.8

2.4

2.1

022 - 39357600 Ext: 6810

RoA (%)

0.6

0.0

0.6

1.0

1.1

RoE (%)

7

0

7

12

13

Note: CMP as of 13/2/19

Please refer to important disclosures at the end of this report

1